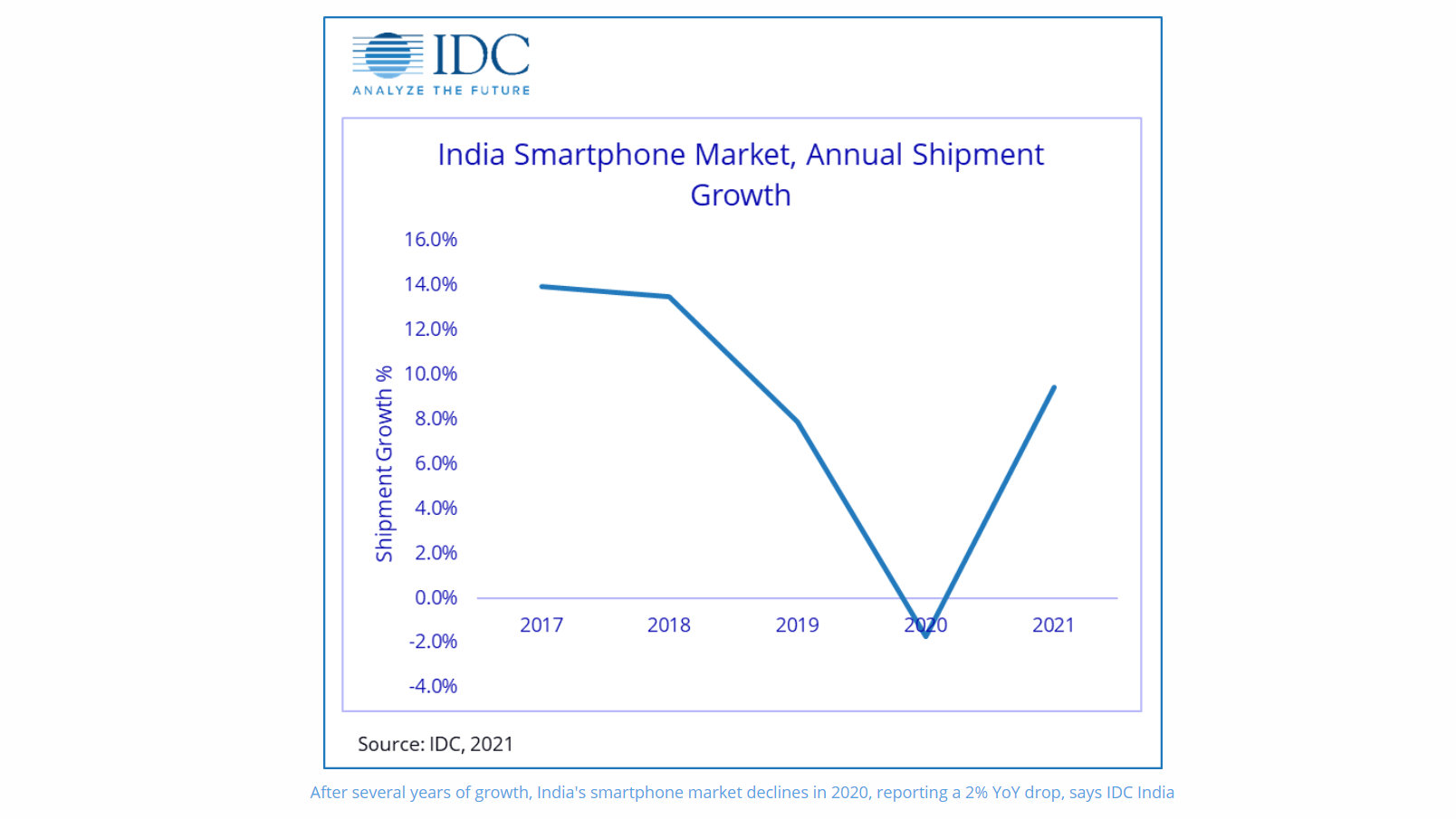

After several years of growth, the pandemic and the lockdown seems to have taken toll on the growth of India smartphone market. For the first time in many years, the Indian smartphone market ended 2020 at 150 million units, a 1.7% YoY decline.

According to the International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker, though smartphone shipments picked up in the last quarter, the overall numbers for the full year remained below the pre-pandemic level.

Navkendar Singh, Research Director, Client Devices & IPDS, IDC India said, “in 2021, IDC expects the smartphone market to grow in high single-digit YoY, driven majorly by upgrading consumers, in the mid-range segment and affordable 5G offerings ($250). Also, revamped offline channel play is anticipated, to bring back growth in the very important brick and mortar counters for long term sustainability.”

- Apple phone-makers in India commit to $900 million investment

- Apple, Samsung among 16 companies get govt. approval to Make in India

Xiaomi continues to top

The IDC report said the online channel outpaced the overall market, growing by 12% annually with a 48% market share in 2020.

MediaTek processor-based smartphone shipments led with a share of 43%, closely followed by Qualcomm at 40% in 2020.

Though 5G is not commercially available in India, 5G smartphone shipments crossed 3 million in 2020, with Chinese OEMs rolling out aggressively-priced devices, including Xiaomi’s Mi 10i.

Xiaomi's performance in 2020 was led by its affordable Redmi 8 series, gradually replaced by the Redmi 9 series. Though it continued to face supply shortages, Xiaomi maintained its leadership in 2020. POCO, Xiaomi's sub-brand, entered the "top 5 online channel vendor list", strengthening Xiaomi's online position at 39% share.

Samsung remained in its second spot in the 2020 ranking, with its online-heavy portfolio driven by the Galaxy M series and the newly launched F series. Online channel registered strong 65% YoY growth, while the offline channel shipments declined by 28%, thus leading to an overall drop of 4% in 2020.

Apple at seventh place

Vivo stood at the third position, with strong growth in the offline channel, dethroning Samsung for the leadership position in the offline channel with 30% share, driven by the affordable Y series.

Realme surpassed Oppo for the fourth slot with 19 million annual shipments, growing by 19% YoY in 2020. It continued to be the second-largest online vendor, with its affordable C-series as a major driver.

Oppo's annual growth remained flat YoY in 2020, while it maintained a focus on the offline channels, and regained its third slot ahead of Xiaomi with an 18% annual share driven by the affordable A series.

Transsion (ranked sixth) accounted for an impressive 64% annual growth in 2020, driven by its online-exclusive Infinix portfolio and its Itel and Tecno-branded phones widely available in smaller towns and rural areas.

Apple, at the seventh slot, exited 2020 with YoY growth of 93%, driven by previous generation products like the iPhone 11, iPhone SE (2020), and iPhone XR, even as the new iPhone 12 series had a strong pickup in 4Q20.

Via: IDC

from TechRadar - All the latest technology news https://ift.tt/3u2Kjve